How I Tamed Corporate Taxes and Boosted My Bottom Line—For Real

You’re not alone if corporate tax season feels like walking through a maze blindfolded. I’ve been there—overpaying, stressing, making avoidable mistakes. But after years of trial, error, and real-world testing, I cracked parts of the code. This isn’t about shady loopholes or risky moves. It’s about smart, legal strategies that actually work. Let me walk you through what transformed my business finances—and could do the same for yours. These are not theoretical ideas pulled from textbooks; they’re battle-tested methods applied in real businesses, including my own, that led to measurable savings, stronger cash flow, and greater confidence during tax season. The goal isn’t to eliminate taxes—that’s neither possible nor legal—but to pay only what’s fair, no more, and to use the savings to fuel growth, stability, and long-term success.

The Corporate Tax Trap Everyone Falls Into (And How to See It Coming)

One of the most common and costly errors small and mid-sized businesses make is mistaking revenue for profit when estimating tax obligations. Many owners look at their bank statements at year-end, see a healthy inflow of money, and assume they owe taxes on all of it. But taxable income isn’t the same as sales. It’s what remains after allowable expenses are deducted. The trap lies in failing to capture or properly classify those expenses throughout the year, leading to an artificially high taxable income. This misstep doesn’t just increase tax liability—it can drain cash reserves needed for operations, expansion, or emergencies.

Consider a real-world scenario: a boutique consulting firm with $850,000 in annual revenue. On the surface, that sounds substantial. But after accounting for salaries, software subscriptions, travel, insurance, and office costs, their actual net profit might be closer to $220,000. Without diligent tracking, however, the owner may have deducted only $400,000 in expenses, leaving $450,000 as taxable income. That mistake could result in tens of thousands of dollars in unnecessary taxes. The issue isn’t fraud or evasion—it’s oversight. And it happens frequently because business owners are focused on delivering services, not parsing accounting rules.

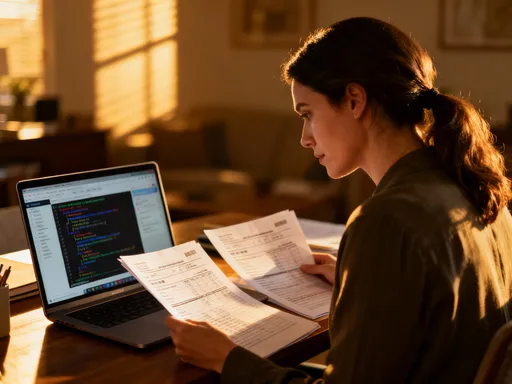

The early warning signs of inefficient tax positioning are often subtle but detectable. One is consistent cash flow strain despite reported profitability. Another is last-minute scrambling to gather receipts in March or April. A third is reliance on a single annual meeting with an accountant, rather than ongoing financial dialogue. These patterns suggest reactive rather than proactive tax management. When tax planning is treated as a once-a-year chore, it becomes a source of stress and lost opportunity. The shift begins with awareness: understanding that every financial decision—from hiring a contractor to renewing a software license—has tax implications. Recognizing this connection allows business owners to make informed choices that align with both operational and financial goals.

Additionally, many businesses fall into the trap of misclassifying expenses, especially as they grow. For instance, costs related to setting up a new location might be incorrectly recorded as current expenses when they should be capitalized and depreciated over time. This distorts both the current year’s tax picture and future filings. Similarly, failing to separate personal and business spending blurs the lines and increases audit risk. The solution isn’t complexity—it’s clarity. By adopting consistent bookkeeping practices and understanding basic tax principles, businesses can avoid these pitfalls and ensure they’re not overpaying simply due to misunderstanding or disorganization.

What Really Counts as a Deductible Expense? (And Where People Go Wrong)

Deductible expenses are the foundation of legal tax reduction, yet confusion persists about what qualifies and how to claim it. The IRS allows businesses to deduct ordinary and necessary costs directly related to generating income. However, not all expenses are treated equally, and the timing and documentation of those expenses are just as important as the expenses themselves. A common mistake is assuming that any business-related cost automatically reduces taxable income. In reality, the nature of the expense—whether it’s operational or capital—determines how and when it can be deducted.

Operational expenses, such as rent, utilities, office supplies, and employee wages, are typically fully deductible in the year they are incurred. These are the day-to-day costs of running a business. Capital expenses, on the other hand—like purchasing equipment, vehicles, or major software systems—are not immediately deductible. Instead, they must be capitalized and depreciated over their useful life. Misclassifying a capital purchase as an operational expense can trigger scrutiny and lead to disallowed deductions. For example, buying a $15,000 piece of machinery cannot be written off entirely in one year under standard depreciation rules, unless bonus depreciation is available and properly applied.

Another frequent error involves the home office deduction. While legitimate for those who use a dedicated space exclusively for business, many claim it incorrectly. Simply working from the kitchen table doesn’t qualify. The space must be used regularly and exclusively for business purposes. Moreover, the deduction is calculated based on the percentage of the home used for business, and only certain types of expenses—like mortgage interest, utilities, and insurance—can be allocated. Claiming the deduction without proper documentation or exceeding allowable limits can raise red flags. The same applies to vehicle mileage: personal trips disguised as business ones, or failing to maintain a contemporaneous log, can invalidate the entire claim.

Even digital tools, which are essential in today’s business environment, require careful handling. Subscription fees for cloud storage, project management software, or cybersecurity services are generally deductible as operational expenses. But if a business pays $10,000 upfront for a three-year license, the cost should be amortized over that period rather than deducted all at once. The key to avoiding mistakes is consistency and documentation. Every expense should be supported by a receipt, invoice, or bank record, and categorized correctly in the accounting system from the outset. This isn’t just about compliance—it’s about creating a clean financial record that supports strategic decision-making and reduces stress at tax time.

Timing Is Everything: When to Spend, When to Hold, and Why It Moves the Needle

Tax planning isn’t just about what you spend—it’s about when you spend it. For businesses using the cash accounting method, income is taxed when received, and expenses are deductible when paid. This gives owners significant control over their tax liability through strategic timing. By accelerating expenses into a high-income year or deferring income to the next year, a business can legally reduce its current tax burden. This isn’t manipulation; it’s smart financial management that aligns cash flow with tax efficiency.

Consider two similar companies, both earning $750,000 in revenue with comparable expenses. Company A pays all its outstanding bills in December, including $40,000 in equipment upgrades and $25,000 in contractor fees. Company B delays those payments until January, assuming the timing doesn’t matter. The result? Company A reduces its taxable income by $65,000 in the current year, potentially saving over $13,000 in federal taxes alone, depending on the tax bracket. Company B loses that benefit and faces a higher tax bill. The operational impact is nearly identical—both companies get the equipment and services they need—but the financial outcome differs significantly due to timing.

Bonus payments to employees or oneself are another area where timing matters. Distributing bonuses in December means the expense is deductible in the current year, lowering taxable income. Waiting until January shifts the deduction to the next year, which may not be advantageous if profits are expected to decline. Similarly, prepaying certain expenses—like insurance premiums or annual software licenses—can yield immediate tax benefits, provided the prepayment doesn’t exceed 12 months. The IRS allows this under the 12-month rule, making it a legitimate tool for tax deferral.

However, timing strategies must be grounded in real business needs. Artificially shifting transactions without economic substance can attract scrutiny. The goal isn’t to create paper losses but to align financial decisions with actual operations. For instance, if a business plans to upgrade its IT infrastructure, doing so in a high-profit year maximizes the tax benefit while supporting growth. The same logic applies to inventory purchases, marketing campaigns, or professional development investments. When spending is both necessary and well-timed, it serves dual purposes: advancing the business and optimizing tax outcomes. This approach transforms tax planning from a reactive obligation into a proactive strategy.

The Depreciation Hack No One Talks About (But Should)

Depreciation is often viewed as a technical accounting requirement, but it’s actually one of the most powerful tools for reducing taxable income over time. Every tangible business asset—computers, machinery, vehicles, furniture—loses value as it’s used. The IRS allows businesses to recover that cost through annual depreciation deductions. While this seems straightforward, many owners miss opportunities to accelerate those deductions and improve cash flow. Methods like MACRS (Modified Accelerated Cost Recovery System) and bonus depreciation enable businesses to take larger deductions in the early years of an asset’s life, effectively deferring taxes and freeing up capital.

Bonus depreciation, in particular, has been a game-changer in recent years. It allows businesses to deduct a significant percentage—sometimes 100%—of the cost of qualifying assets in the year they are placed in service. For example, purchasing a $50,000 delivery van in 2023 could result in an immediate $50,000 write-off if bonus depreciation applies, dramatically reducing that year’s taxable income. This isn’t a loophole; it’s a provision designed to encourage business investment. Yet, many owners either don’t know about it or fail to plan purchases around it, leaving money on the table.

The key is intentionality. Rather than buying equipment when it breaks, businesses can time acquisitions to coincide with high-income years, maximizing the tax benefit. A company expecting a particularly profitable quarter might choose to purchase new servers or upgrade its fleet before year-end. The expense supports operations, but the timing amplifies the financial advantage. Moreover, the cash saved from lower taxes can be reinvested into the business, creating a compounding effect. For instance, a $20,000 tax saving from accelerated depreciation could fund employee training, marketing, or debt reduction—all of which contribute to long-term growth.

However, depreciation requires careful classification. Assets must be correctly categorized by type and recovery period—five years for computers, seven for office furniture, 27.5 for commercial real estate, and so on. Misclassifying an asset can lead to incorrect deductions and potential penalties. Additionally, once a method is chosen, consistency is crucial. Switching methods without justification can raise red flags. The best approach is to work with a tax professional to develop a depreciation strategy that aligns with the business’s financial cycle, ensuring compliance while maximizing benefits. When used wisely, depreciation isn’t just an accounting entry—it’s a strategic lever for financial health.

Paying Yourself Wisely: Salary vs. Dividends and the Tax Ripple Effect

How a business owner compensates themselves has far-reaching implications for both personal and corporate tax liability. In S-corporations, for example, owners often split their income between salary and distributions (dividends). The salary portion is subject to payroll taxes—Social Security and Medicare—while distributions are not. This creates an incentive to minimize salary and maximize distributions. However, the IRS requires owners to pay themselves “reasonable compensation” for the services they provide. Failing to do so can trigger audits, penalties, and back taxes.

Consider a profitable S-corp generating $400,000 in net income. The owner takes a $30,000 salary and distributes the remaining $370,000 as dividends. While this reduces payroll tax liability, it may not withstand IRS scrutiny. If comparable positions in the industry command $120,000, the low salary could be deemed unreasonable. The IRS might reclassify part of the dividends as wages, resulting in additional payroll taxes, interest, and penalties. The smarter approach is to set a salary that reflects market rates—say, $110,000—while still benefiting from lower payroll taxes on the remaining distributions. This balances tax efficiency with compliance.

The choice between salary and dividends also affects retirement planning and self-employment tax. Higher salaries increase contributions to Social Security and Medicare, which can translate into higher future benefits. They also allow for greater contributions to retirement accounts like 401(k)s or SEP-IRAs, further reducing taxable income. Distributions, while tax-efficient in the short term, don’t contribute to retirement credits or enable retirement plan contributions. Therefore, the decision should consider not just current tax savings but long-term financial security.

Retained earnings—the profits kept within the company rather than distributed—also play a role. While C-corporations face double taxation (once at the corporate level, again at the individual level), S-corps avoid this. Still, retaining earnings in an S-corp can be strategic, allowing funds to be reinvested in growth, equipment, or emergency reserves without triggering immediate personal tax liability. The key is balance: ensuring enough liquidity for personal needs while optimizing the business’s financial structure. Thoughtful compensation planning isn’t about minimizing taxes at all costs—it’s about creating a sustainable, compliant, and efficient system that supports both the business and the owner’s financial well-being.

Audit-Proofing Your Books: Simplicity Beats Complexity Every Time

The fear of an audit is real, but the best defense isn’t complexity or concealment—it’s transparency and consistency. The IRS is more likely to scrutinize returns that show inconsistencies, unusual deductions, or poor documentation. A clean, well-organized set of books is not only easier to file but also far less likely to attract attention. Simplicity, when paired with accuracy, is the hallmark of a compliant and confident taxpayer. The goal isn’t to hide income or inflate expenses, but to present a clear, truthful picture of the business’s financial activity.

Documentation is the cornerstone of audit readiness. Every deduction should be supported by a receipt, invoice, or bank statement. For travel, meals, and vehicle use, contemporaneous records—logs with dates, purposes, and amounts—are essential. Digital tools like expense tracking apps and cloud-based accounting software make this easier than ever. They automate categorization, store receipts electronically, and generate reports that align with tax forms. But technology alone isn’t enough. The business must establish internal controls—regular reviews, separation of duties, and standardized approval processes—to ensure data integrity.

Another critical factor is alignment with industry norms. A consulting firm deducting $50,000 in vehicle expenses may raise questions if the owner rarely travels. Similarly, a retail business claiming an unusually high percentage of home office deductions could trigger scrutiny. The IRS uses benchmark data to compare businesses in the same sector. Staying within reasonable ranges for expense-to-revenue ratios reduces red flags. When an expense is legitimate but atypical, clear documentation and a written explanation can provide context and prevent misunderstandings.

Finally, working with a qualified tax professional adds another layer of protection. A good CPA or enrolled agent doesn’t just prepare returns—they review financials, identify risks, and ensure compliance with current regulations. They can also represent the business in the event of an audit, providing expertise and reducing stress. Audit-proofing isn’t about fear; it’s about confidence. When books are accurate, consistent, and well-documented, the business owner can focus on growth, knowing they are on solid ground.

Building a Tax-Smart Business Culture (Beyond the Accounting Department)

Tax efficiency shouldn’t rest solely on the shoulders of the accountant or bookkeeper. It should be embedded in the culture of the entire organization. When employees in procurement, HR, and operations understand basic tax principles, small decisions add up to significant savings. For example, a purchasing agent who knows that equipment over a certain threshold must be capitalized will code it correctly from the start. An HR manager who understands the rules for accountable vs. non-accountable expense reimbursements can structure policies to minimize taxable income for employees and the company.

Simple habits make a difference. Requiring employees to submit mileage logs with dates and business purposes ensures vehicle deductions are valid. Training staff to capture receipts immediately—via smartphone apps—prevents lost documentation. Even coding expenses to the right account in the accounting system at the point of entry reduces errors and saves time during tax season. These practices don’t require financial expertise; they require awareness and discipline.

Leadership plays a crucial role in fostering this culture. Regular training sessions, clear policies, and consistent enforcement send the message that tax compliance is everyone’s responsibility. Annual tax reviews should be integrated into the broader financial planning process, not treated as a separate event. These reviews should assess not just past performance but future opportunities—such as upcoming depreciation changes, tax credits, or shifts in income that could affect planning.

Ultimately, turning tax planning into a strategic advantage means moving from reaction to anticipation. It means viewing every financial decision through a tax-aware lens, not to avoid obligations, but to fulfill them efficiently and wisely. When done right, this approach doesn’t just reduce tax bills—it strengthens the entire financial foundation of the business. It builds resilience, improves cash flow, and creates confidence. And for any business owner who’s ever felt overwhelmed by tax season, that peace of mind is worth more than any deduction.